Скачать с ютуб How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance) в хорошем качестве

Slope & Covariance)

AJL Investing

how to find beta

excel how to beta

capm how to calculate beta

How to Calculate Beta In Excel - All 3 Methods (Regression

calculate beta

excel how to calculate beta

beta finance

how to calculate systematic risk excel

beta calculation excel

security market line excel

yahoo finance

regression

slope

variance covariance matrices excel

Скачать бесплатно и смотреть ютуб-видео без блокировок How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance)

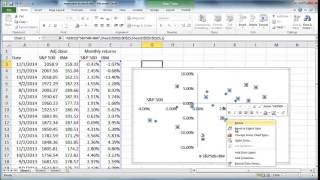

How to Calculate Beta In Excel - All 3 Methods (Regression, Slope & Covariance) Subscribe! What is Beta A stock that swings more than the market over time has a beta greater than 1.0. If a stock moves less than the market, the stock's beta is less than 1.0. High-beta stocks tend to be riskier but provide the potential for higher returns; low-beta stocks pose less risk but typically yield lower returns. As a result, beta is often used as a risk-reward measure meaning it helps investors determine how much risk their willing to take to achieve the return for taking on that risk. A stock's price variability is important to consider when assessing risk. If you think of risk as the possibility of a stock losing its value, beta has appeal as a proxy for risk. How to Calculate Beta To calculate the beta of a security, the covariance between the return of the security and the return of the market must be known, as well as the variance of the market returns. AJL Investing