Скачать с ютуб Personal Bad Debt Tax Deduction в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Personal Bad Debt Tax Deduction в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Personal Bad Debt Tax Deduction или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Personal Bad Debt Tax Deduction в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

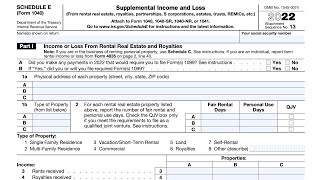

Personal Bad Debt Tax Deduction

https://www.etax.com/ If someone owes you money that you can't collect, you may have a bad debt. Generally, to deduct a bad debt, you must have previously included the amount in your income. You generally can't take a bad debt deduction for unpaid salaries, wages, rents, fees, and similar items, since they were never included in income If you lend money to a relative or friend with the understanding that it is not a gift and they must repay it, and they don't, you may deduct it as a bad debt. Bad debt must be totally worthless to be deductible. To show that a debt is worthless, you must establish that you've taken reasonable steps to collect the debt. It's not necessary to go to court if you can show that a judgment from the court would be uncollectible. You don't have to wait until a debt is due to determine that it's worthless. Report a nonbusiness bad debt as a short-term capital loss on Form 8949. A nonbusiness bad debt deduction requires a separate detailed statement attached to your return. The statement must contain: a description of the debt, including the amount and the date it became due; the name of the debtor, and any business or family relationship between you and the debtor; the efforts you made to collect the debt; and why you decided the debt was worthless.