Скачать с ютуб Earnings Per Share (EPS) - Basics, Formula, How to Calculate? в хорошем качестве

earnings per share

eps

earnings per share definition

earnings per share explained

earnings per share formula

earnings per share calculation

earnings per share ratio

earnings per share example

what is earnings per share

earnings per share ratio explained

what is eps

eps explained

earning per share

earnings per share calculator

earnings per share equation

eps formula

earnings per share interpretation

earnings per share how to calculate

Скачать бесплатно и смотреть ютуб-видео без блокировок Earnings Per Share (EPS) - Basics, Formula, How to Calculate? в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Earnings Per Share (EPS) - Basics, Formula, How to Calculate? или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Earnings Per Share (EPS) - Basics, Formula, How to Calculate? в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Earnings Per Share (EPS) - Basics, Formula, How to Calculate?

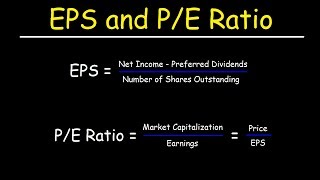

In this video, we will talk about Earnings Per Share, how it is calculated and how it is used in valuations to understand the potential of a business. Chapters 00:00 Introduction 01:01 What is Earnings Per Share? 02:23 EPS Calculation 03:40 EPS Calculation with Preferred Dividends 05:20 Trailing, Current and Forward EPS 06:16 Using EPS in Valuation PE Ratio What is EPS? EPS is defined as the ratio of net income to the total number of ordinary shares issued by the company. It is a number that helps investors figure out if the company is worth investing in or not. There are three types of EPS: Trailing EPS, Current EPS, and Forward EPS. EPS is used to calculate the PE ratio, which is the Stock Price/Earnings Per Share. There are two types of EPS: Basic and Diluted. Formula for EPS = (Net Income – Preferred Dividends) / Number of Common Shares Importance of EPS An important metric for investment analysis Also used in ratio analysis for comparable periods Limitations of EPS Misrepresented while pursuing buyback of shares Chances of manipulation Doesn’t broadly account for financial leverage #earningpershare, #wallstreetmojo, #EPS For more details, you can refer to our article at - https://www.wallstreetmojo.com/earnin... Subscribe to Our Channel - Youtube ► / @wallstreetmojo LinkedIn ► / mycompany Facebook ► / wallstreetmojo Instagram ► / wallstreetmojoofficial Twitter ► / wallstreetmojo