Скачать с ютуб Investment Planning in Telugu - Invest Rs 5000 and Get 6 Crore | Smart Investment Tips | Kowshik в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Investment Planning in Telugu - Invest Rs 5000 and Get 6 Crore | Smart Investment Tips | Kowshik в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Investment Planning in Telugu - Invest Rs 5000 and Get 6 Crore | Smart Investment Tips | Kowshik или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Investment Planning in Telugu - Invest Rs 5000 and Get 6 Crore | Smart Investment Tips | Kowshik в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

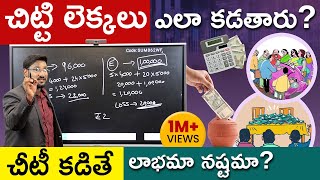

Investment Planning in Telugu - Invest Rs 5000 and Get 6 Crore | Smart Investment Tips | Kowshik

✅Download ffreedom app:- https://ffdm.app/dbyQ 📚 Related Courses 📚 🔥 Get up to 50% off on ➡️Financial Freedom Course💰 - https://ffdm.app/H5Ap ➡️Stock Market Course📈 - https://ffdm.app/MbJY ➡️Mutual Funds Course📈 - https://ffdm.app/SLup ➡️Course on Credit Card💳 - https://ffdm.app/qhtn ➡️Credit Score Course📊 - https://ffdm.app/nneZ 🔰Connect on Telegram - https://t.me/financialfreedomapp 🔰Connect on Whatsapp - https://whatsapp.com/channel/0029VaZm... Investment Planning in Telugu - Invest Rs 5000 and Get 6 Crore | Smart Investment Tips | Kowshik Here are some steps you can follow to start investment planning: Set financial goals: Determine what you want to achieve with your investments, whether it's building wealth, saving for retirement, or some other financial goal. Assess your risk tolerance: Consider your comfort level with risk and your ability to handle fluctuations in the value of your investments. This will help you determine the types of investments that are most suitable for you. Create a budget: Determine how much money you have available to invest and allocate it in a way that aligns with your financial goals and risk tolerance. Diversify your portfolio: Spread your investments across various asset classes, such as stocks, bonds, and cash, to minimize risk and optimize returns. Consider working with a financial advisor: A financial advisor can help you develop a personalized investment plan that considers your specific financial situation and goals. Review and adjust your plan regularly: Monitor your investments and make necessary changes to ensure that your portfolio remains aligned with your financial goals. Investment planning requires careful consideration of your financial goals, risk tolerance, and budget, as well as a focus on diversification and regular review and adjustment. By following these steps, you can set yourself on a path to achieve your financial objectives. DISCLAIMER We are not SEBI Registered and this video is for educational purposes only and should not be considered as financial advice or an endorsement of specific investments. It is essential to conduct thorough research before making any investment decisions. #investmentplanning #investments #financialgoals #assetallocation #diversification #portfoliomanagement #investmentstrategies #savingsplan #budgeting