Скачать с ютуб Session 7: Cost of Debt & Capital & First Steps on Cash Flows в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Session 7: Cost of Debt & Capital & First Steps on Cash Flows в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Session 7: Cost of Debt & Capital & First Steps on Cash Flows или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Session 7: Cost of Debt & Capital & First Steps on Cash Flows в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Session 7: Cost of Debt & Capital & First Steps on Cash Flows

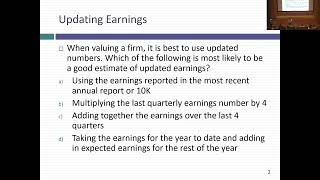

In this class, we started with the cost of debt and computing debt ratios for companies and how to deal with hybrid securities.. If you are interested in getting updated default spreads (on the cheap or free), try this site: https://content.naic.org/search?q=def... While that link will give you end spreads, they do update the numbers monthly, but seem to do an awfully poor job of making the spreadsheet findable. You can also try the St. Louis FRED and find updated on seven major ratings classes (AAA, AA, A, BBB, BB, B, C and lower) updated daily. Neat, right? You can get the spreads from Bloomberg as well, using the FIW function, and tweaking the choices to show all corporate spreads. We then moved on to getting the base year's earnings right and explored several issues: 1. To get updated numbers, you should be using either trailing 12 month numbers or complete the current year with forecasted numbers. In either case, your objective should be to get the most updated numbers you can for each input rather than be consistent about timing. 2. To clean up earnings, you have to correct accounting two biggest problems: the treatment of operating leases as operating (instead of financial) expenses and the categorization of R&D as operating (instead of capital) expenses. The biggest reason for making these corrections is to get a better sense of how much capital has been invested in the business and how much return this capital is generating. Start of the class test: https://www.stern.nyu.edu/~adamodar/p... Slides: https://www.stern.nyu.edu/~adamodar/p... Post class test: https://www.stern.nyu.edu/~adamodar/p... Post class test solution: https://www.stern.nyu.edu/~adamodar/p...