Скачать с ютуб Self Managed Super Funds (SMSFs) EXPLAINED в хорошем качестве

box advisory services

box as

davie mach

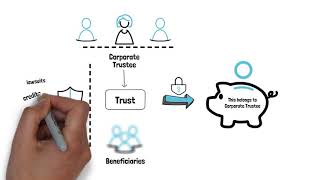

self-managed super funds

SMSFs

what is SMSFs

what are the advantages of SMSFs

what are the disadvantages of SMSFs

SMSFs investment strategy explained

withdrawing money from SMSFs

contributions and rollovers explained

how are SMSFs taxed

how can I benefit from SMSFs

is acquiring SMSFs worth it

what are the pros and cons of SMSFs

what to report and lodge on SMSFs

how can my accountant help me manage SMSFs

SMSfs explained

Скачать бесплатно и смотреть ютуб-видео без блокировок Self Managed Super Funds (SMSFs) EXPLAINED в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Self Managed Super Funds (SMSFs) EXPLAINED или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Self Managed Super Funds (SMSFs) EXPLAINED в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Self Managed Super Funds (SMSFs) EXPLAINED

Looking for stress-free, fixed-fee accounting services? Book a FREE consultation with us: https://boxas.com.au/book-meeting/ Need cloud accounting software? Sign up for Xero: https://xero5440.partnerlinks.io/boxas (this is an affiliate and I will make a small commission at no extra cost to you) SMSFs or Self-Managed Super Funds are becoming a popular option Australians appear to be shifting towards. It's a way for Australians to have full control over their investment options for their retirement funds. But what are the pros and cons of SMSFs? How can you acquire and benefit from it? Let me break down everything you need to know about SMSFs. CHAPTERS: 00:00 - Overview 01:08 - What are the Advantages of SMSFs 02:22 - What are the Disadvantages of SMSFs 05:49 - SMSF Investment Strategy Explained 06:32 - Withdrawing Money from the SMSFs 07:06 - Contributions and Rollovers 08:32 - How are SMSFs taxed? 09:55 - What to Report and Lodge? 10:38 - Final Thoughts — Thank you for watching this video. I post weekly videos on this channel to provide the latest and most frequently asked business questions. Please take a second to say hi in the comments below. If you enjoy my content and find it valuable, subscribe to the channel, like and share it with anyone you think might find my channel useful! — ► Subscribe to my channel here: / daviemach — Davie has over 10 years of experience in advising businesses in management accounting and taxation issues. He heads up a passionate team at Box Advisory Group who are dedicated to offering proactive and outstanding service to our clients. Davie’s extensive experience in providing tax and consulting advice and astute business knowledge has paved the way for success for many businesses. He is a member of the Chartered Accountants Australian and New Zealand, a member of the Australian Tax Practitioners Board and holds a Bachelor of Commerce degree from the University of New South Wales. — Follow Me: LinkedIn: / Instagram: / Facebook: / Website: https://boxas.com.au/ — DISCLAIMER: Please note that every effort has been made to ensure that the information provided in this video is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to contractors and small businesses. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal or tax advice. You should, where necessary, seek your own advice for any legal or tax issues raised in your business affairs.