Скачать с ютуб Best Finviz Stock Screener Setup For Swing Trading [Tutorial] в хорошем качестве

finviz stock screener day trading

finviz stock screener

finviz stock screener swing trading

finviz screener

finviz screener for swing trade

swing trading

finviz swing trade scan

stock screener

finviz stock screener setup

finviz stock screener tutorial

stock trading

finviz

finviz tutorial

swing trading stocks

stock scanners for swing trading

how to use finviz stock screener

finviz stock screener breakout

swing trading scanner setup

stock market

Скачать бесплатно и смотреть ютуб-видео без блокировок Best Finviz Stock Screener Setup For Swing Trading [Tutorial] в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Best Finviz Stock Screener Setup For Swing Trading [Tutorial] или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Best Finviz Stock Screener Setup For Swing Trading [Tutorial] в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Best Finviz Stock Screener Setup For Swing Trading [Tutorial]

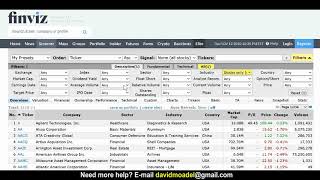

Hi, in this video, I will share with you my own finviz stock screener setup for short term swing trading. Here are the parameters I use. Feel free to change them to your own personal style. I have set the market cap to at least 50 million or more to avoid trading penny stocks. I have also set the industry to only stocks as I find that they give me better opportunities than indexes. I will not trade any non US stocks as they generally tend to have large gaps overnight, making it harder to trade, especially for options. The only fundamental metric I look at is sales growth quarter over quarter. This is based on facts and not reliant on opinions from analysts. Since I trade options, specifically poor man’s covered calls, I have the option slash short trade set to optionable. Next, I prefer to have the stock be above their 200 day and 50 day moving averages. This is primarily to trade the trend up. As Martin Zweig says “The Trend Is Your Friend”. It is better to trade with it rather than against it. My strategy does not work well in bear markets, so I will not trade if the US indexes are below their 200 day moving average. I also have the beta set to be above 1 to have higher volatility and it is great for selling calls to get higher premiums. As for volume, I have it at over 1 million to make sure it is liquid enough to get in and out of the trade. This is especially important for options as slippage can be deadly. However, if you are trading shares, 500 thousand volume is more than enough. Price is set above $3 as well to avoid running into penny stocks. Lastly, the stock needs to be at least 1 year old for me to start trading it. Now that all the filters are explained, I will go to the TA tab and start looking for potential stocks to add to my tradingview watch list. I generally like stocks that are pulling back or have some sort of consolidation pattern such as bull flags or bases to find potential entries with good risk to reward ratios. This whole process can take some time, but it is worth it because I am usually able to find 1 or 2 stocks to execute the strategy in an uptrending market. Trading is all about managing risk. Be patient and enjoy the process. Thanks for watching! #finviz #stockscreener Related Search Terms Best Finviz stock screener settings for swing trading Finviz screener setup for swing traders Optimal Finviz filters for swing trading Swing trading stock picks using Finviz Finviz swing trading strategy settings How to use Finviz for swing trading Top Finviz screeners for swing trading Finviz setup guide for swing trading Swing trading with Finviz screener tips Effective Finviz parameters for swing trading Copyright Disclaimer: - Under section 107 of the copyright Act 1976, allowance is made for FAIR USE for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non- Profit, educational or personal use tips the balance in favor of FAIR USE.