Скачать с ютуб File TDS Correction Online| Latest Process в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок File TDS Correction Online| Latest Process в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно File TDS Correction Online| Latest Process или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон File TDS Correction Online| Latest Process в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

File TDS Correction Online| Latest Process

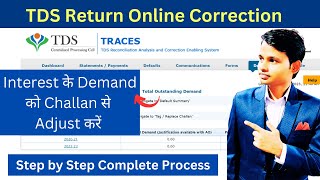

This video explains How to pay Late filing fee u/s 234e & how to File TDS Correction Return Online Yourself mExpert Tips And Tricks To Buy A Property From An NRI ! - • Are you sure of buying property from ... How to apply for TAN - • How to apply for a New TAN online in ... Pay TDS – Can use TDS Return (234E) link TDS return(form 27Q-payment to Non-Resident) – • Payment to Non-Resident| How to file ... How to register on Traces Website as Deductor - • Traces Website registration as Deduct... How to issue Form 16A - • How to issue Form 16A | Form 16 vs 16... TDS return U/s 234e (Late Filing) - • File TDS Correction Online| Latest Pr... Change Owner(Name/ Mobile) in Property Tax - • No Dues Certificate| Change Owner(Nam... Pay Property Tax Online - • New Process | No Dues Certificate| Pa... Buy or Rent a house ? - • Confused? Guaranteed Decision ! Buy o... Best REIT in India - • Best REIT in India| Real Estate Inves... As per section 234E, where a person fails to file the TDS/TCS return on or before the due date prescribed in this regard, then he shall be liable to pay, by way of fee, a sum of Rs. 200 for every day during which the failure continues. The amount of late fees shall not exceed the amount of TDS. Website Links https://eportal.incometax.gov.in/iec/... https://contents.tdscpc.gov.in/ How to pay Section 234E demand ? The following steps shall help you analyze and pay the demand Download the Justification Report from TRACES portal to view your latest outstanding demand. On downloading the Justification Report, pay the above with your relevant Banker or use any other Challan, which has adequate balance available In case of payment towards late filing fee, please Tag the challan towards the payment, in the “Fee” column” using RPU Ver. 3.8, mentioning appropriate amount in such column and validate to generate the FVU. Submit the Correction Statement at TIN Facilitation Centre. The demand can also be paid by using the Online Correction facility.