Скачать с ютуб SpotGamma Education: Methodology and Case Studies (INTC, TSLA, RIOT) with Brent Kochuba в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок SpotGamma Education: Methodology and Case Studies (INTC, TSLA, RIOT) with Brent Kochuba в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно SpotGamma Education: Methodology and Case Studies (INTC, TSLA, RIOT) with Brent Kochuba или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон SpotGamma Education: Methodology and Case Studies (INTC, TSLA, RIOT) with Brent Kochuba в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

SpotGamma Education: Methodology and Case Studies (INTC, TSLA, RIOT) with Brent Kochuba

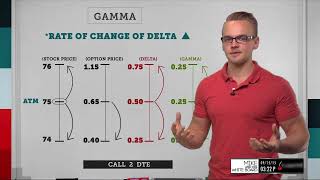

SpotGamma shares options and stock market insights and the methodology for how SpotGamma can be used to inform trading and investing strategy. Subscribe to SpotGamma here: https://spotgamma.com/subscribe-to-sp... Get more gamma insights: SUBSCRIBE on YouTube ➡ https://www.youtube.com/c/spotgamma?s... SpotGamma Methodology: analyzing hedging volumes and market movement, applying the Greeks, the S&P 500 relationship with Gamma, how options impacted the crash at the beginning of the Covid-19 pandemic, plus case studies examining options with examples from Intel (INTC), Tesla (TSLA) and Riot Blockchain (RIOT). This video is PART 4 in an educational series that covers stocks, options, Greeks and how the SpotGamma methodology uses millions of data points to present actionable options metrics to our subscribers. — 0:00 Introduction 2:19 SpotGamma Perspective: Hedging Volumes can Move Markets 3:12 Analyzing Hedging Volumes 4:26 Application of the Greeks (Delta, Gamma, Charm, Vanna) 5:53 ETF Case Study One: S&P 500 Relationship with Gamma 8:12 ETF Case Study One, ctd.: Options Expiration at the Start of Covid-19 10:30 Stock Case Study Two: Intel (INTC) 11:54 Stock Case Study Three: Tesla (TSLA) 13:56 Stock Case Study Four: Riot Blockchain (RIOT) 15:03 Summary — Part 1: Introduction to Stocks (Beginner) | with SpotGamma Co-Founder, Matt Fox: • Introduction to Stocks with Matt Fox ... Part 2: Introduction to Options (Beginner) | with SpotGamma Co-Founder, Matt Fox: • Introduction to Options, Calls and Pu... Part 3: Introduction to The Greeks (Intermediate) | with SpotGamma Founder, Brent Kochuba: • Introduction to Options Greeks (Delta... Part 4: SpotGamma Methodology (Advanced) | with SpotGamma Founder, Brent Kochuba: • SpotGamma Education: Methodology and ... — STAY CONNECTED TO SPOTGAMMA Website: https://spotgamma.com/ YouTube: https://www.youtube.com/c/spotgamma?s... Twitter: / spotgamma — *Note: This presentation is intended for general information and entertainment purposes only. No mention of company names, trading strategies or illustrative examples constitute investment advice. SpotGamma advises you to seek investment advice from a licensed professional. ### Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

![Business Analyst Full Course [2024] | Business Analyst Tutorial For Beginners | Edureka](https://i.ytimg.com/vi/czymrnQV2p4/mqdefault.jpg)