Скачать с ютуб The U.S. Stock Exchanges в хорошем качестве

aktien

aktien für anfänger

colmex

day trade

day trader

day trading

day trading course

day trading live

day trading stocks

daytrading chatroom

how to day trade

investing

live day trading

live trading

meir barak

nasdaq

online investing

stock market

stock trading

swing trading

technical analysis

tradenet

trading

trading for profit

trading live

trading stocks

meir barack

live stock

day trading meir barak

The U.S. Stock Exchanges

US stock exchanges

Скачать бесплатно и смотреть ютуб-видео без блокировок The U.S. Stock Exchanges в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно The U.S. Stock Exchanges или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон The U.S. Stock Exchanges в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

The U.S. Stock Exchanges

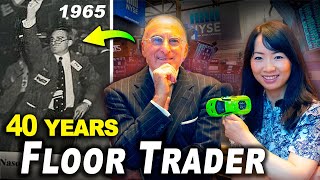

✅ Free Trial, Tradenet Trading Room: https://bit.ly/2YruEtX ✅ Free $10,000 Trading Challenge: https://bit.ly/3DVJ1XG ✅ "The Market Whisperer" Book, Free Part 1: https://bit.ly/2Vn5Hik ✅ Learn To Trade Stocks: https://bit.ly/2YyPnfC ✅ Learn To Trade Crypto: https://bit.ly/3h4jJgk ✅ Tradenet Plus: https://bit.ly/38HpHiK Join Our Facebook Group: https://bit.ly/3BNyHPW Follow My Social Media: Instagram: https://bit.ly/3DTcr8X Twitter: https://bit.ly/2WZK48y Facebook Page: https://bit.ly/3DUs1kE TikTok: https://bit.ly/3h7dOay Twitch: https://bit.ly/3yOKZFC Stocktwits: https://bit.ly/3zPi8SR Refer A Friend, Get Rewarded: https://bit.ly/3kWn6XX Visit Our Website: https://bit.ly/3zKY0Br Contact Us: https://bit.ly/3h4kMNi #StockMarket #Trading #DayTrading The U.S. Stock Exchanges The U.S. stock market comprises three major stock exchanges for day trading. Stock exchanges are businesses that make their profits from commissions and services. The stock exchanges compete among themselves by appealing to different business niches. Each stock exchange has its own unique specialties, technologies, advantages, and, of course, disadvantages. If you’re looking for an introduction to day trading in the US, here’s your basic guide. Meet the New York Stock Exchange The New York Stock Exchange (NYSE) is located on the corner of Wall and Broad streets. It is the largest stock exchange in the world, based on the market value of the companies traded on it, and therefore the highest number of day traders participate on this exchange. The market value, known as market capitalization or “market cap,” multiplies the number of publicly held shares of stock by the exchange-traded price of each share. The market cap of stocks traded in the NYSE exceeded $21 trillion as of June 2017. The NYSE trading list comprises more than 3,000 companies. It wasn't so long ago that NYSE market orders were handled by humans known as floor traders. In those days, the execution time of an NYSE transaction could take up to two minutes. But the unavoidable has happened to the world's largest stock exchange. The revolution started slowly. Nasdaq, the United States’ first computerized stock exchange, became the model when it began operations in 1971. It took some time, but computers have now taken over most processes at the NYSE, despite strong opposition by the day traders. Computerized day trading has provided exactly what the public wanted: greater competition, fewer commissions, greater transparency, and higher execution speed. Meet the Nasdaq The Nasdaq (formerly known as NASDAQ when it was an acronym for National Association of Securities Dealers Automated Quotations) was established in 1971 as the world's first electronic stock exchange. Unlike the NYSE, it immediately computerized all of its trade processes. From that point on, day traders no longer needed to compete over each other’s shouts on the trading floor. Everything was push-button. The result: commissions slowly dropped, the quality of service improved, competition grew, and companies of a new type issued stocks and raised trillions of dollars. Within two decades, and with the proliferation of the internet, Nasdaq was accessible in the home of every trader. For the first time, the road to private trading was opened, day trading classes were being offered as were more services for beginner day traders. We can, in fact, say that the profession of day trading as we know it was born with Nasdaq’s founding. Meet the NYSE American The NYSE American was first established in 1842 as the American Stock Exchange. The NYSE acquired this stock exchange in 2008. NYSE American is now the NYSE's market for small-cap companies. Like the NYSE, it now has moved its processes to quick, effective computerized execution.