Скачать с ютуб How to Calculate Your Estimated Quarterly Taxes? в хорошем качестве

1040 ES

Quarterly Taxes

Estimated Quarterly Taxes

1040 Sch C

Self-Employment Taxes

Self Employment

Extrapolation

Deductions

Tax

Taxes

Tax Filing

Tax Tips

Tax return mistake

taxes 2020

I hate Taxes

taxes small business

taxes 2019

finances

XQ CPA

XQCPA

Charlene Quah

CPA

Business Finance

Houston Businesses

Small Business

Filing Your Taxes

Sole Prop

S Corporation

S Corp

Скачать бесплатно и смотреть ютуб-видео без блокировок How to Calculate Your Estimated Quarterly Taxes? в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How to Calculate Your Estimated Quarterly Taxes? или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How to Calculate Your Estimated Quarterly Taxes? в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

How to Calculate Your Estimated Quarterly Taxes?

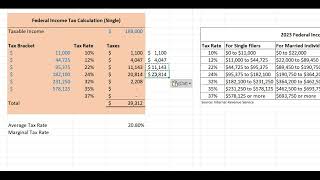

What are Quarterly Taxes? Quarterly Taxes (or estimated taxes) are how self-employed individuals have to pay their taxes to the IRS throughout the year if your income exceeds a certain amount. If you own a business and your business is profitable, you need to pay quarterly taxes each quarter to avoid underpayment penalties. Generally speaking, you'll divide your tax liability for the previous year by four, and the net result will be your estimated payments for each quarter. However, due to the pandemic, the tax position for many businesses has changed drastically compared to previous years. We have good news and we have bad news, the good news is your Q1 and Q2 payments are not due until July 15. The bad news is you still need to pay quarterly payments. In this video, we go in detail to show you how to calculate your estimated tax payments. If you have any questions please contact us at: (832) 295-3353 Set up an appointment with us today: https://xqcpa-bookme.acuityscheduling... Visit us: https://www.xqcpahouston.com/ Follow us to get the latest updates: / xqcpa Like us on Facebook: / xqcpa #QuarterlyTaxes #EstimatedTaxes #Taxes 00:00 - Intro 00:45 - 1040 ES 01:08 - Case One 02:44 - Exploration 03:04 - Case Two 03:53 - Outro