Скачать с ютуб Temporary vs. Permanent Tax Differences in Financial Accounting в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Temporary vs. Permanent Tax Differences in Financial Accounting в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Temporary vs. Permanent Tax Differences in Financial Accounting или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Temporary vs. Permanent Tax Differences in Financial Accounting в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Temporary vs. Permanent Tax Differences in Financial Accounting

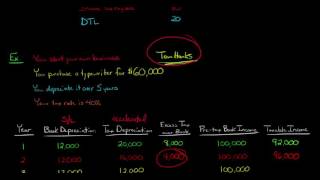

This video discusses the difference between a temporary tax difference and a permanent tax difference. Tax differences arise because "book income" (income computed for financial reporting purposes, according to GAAP) is different from "tax income" (income computed for purposes of calculating the amount of corporate income tax due). Temporary tax differences reverse over time, whereas permanent tax differences never reverse. For example, the IRS allows U.S. firms to accelerate their depreciation deductions. This often results in firms front-loading the depreciation expense of an asset (taking more depreciation in the early years of the asset, and less depreciation in the later years of the asset). This difference is only temporary, however, as the same total amount of depreciation is taken for both book and tax purposes. Thus, the difference is merely one of timing, and it reverses itself over time. Permanent tax differences never reverse. An example of a permanent tax difference is the proceeds from a life insurance policy. Life insurance proceeds are not taxable so they will never appear in taxable income. Life insurance proceeds do appear in book income, however, so this creates a permanent tax difference (it does not reverse in a later period). This video was funded by a Civic Engagement Fund grant from the Gephardt Institute for Civic and Community Engagement at Washington University in St. Louis. — Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education accessible to all people. — SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS & OTHER FREE GUIDES http://eepurl.com/dIaa5z — MICHAEL’S STORY https://www.edspira.com/about/ — LISTEN TO THE SCHEME PODCAST Apple Podcasts: https://podcasts.apple.com/us/podcast... Spotify: https://open.spotify.com/show/4WaNTqV... Website: https://www.edspira.com/podcast-2/ — CONNECT WITH EDSPIRA Website: https://www.edspira.com Instagram: / edspiradotcom LinkedIn: / edspira Facebook: / edspira Reddit: / edspira *TikTok: / edspira — CONNECT WITH MICHAEL LinkedIn: / prof-michael-mclaughlin Twitter: / prof_mclaughlin Instagram: / prof_mclaughlin Snapchat: / prof_mclaughlin *TikTok: / prof_mclaughlin — HIRE MCLAUGHLIN CPA Website: http://www.MichaelMcLaughlin.com/hire-me