Скачать с ютуб Top 8 Ways of Using the Andrews Pitchfork в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Top 8 Ways of Using the Andrews Pitchfork в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Top 8 Ways of Using the Andrews Pitchfork или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Top 8 Ways of Using the Andrews Pitchfork в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Top 8 Ways of Using the Andrews Pitchfork

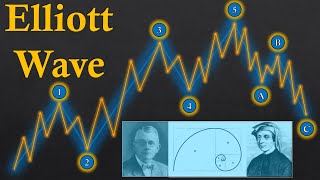

This is a video about price action, elliott wave, dow theory, cycle analysis, support and resistance, chart patterns, and the pitchfork. FRACTAL FLOW WEBSITE: https://www.fractalflowpro.com/ (better seen on desktop!) PRICE ACTION COURSES: https://fractal-flow-price-action.dpd... STRATEGY STORE: https://fractal-flow.dpdcart.com/ INSTITUTIONAL TRADING EBOOKS: https://fractal-flow-institutional-tr... ADVANCED TRADING COURSES: https://fractal-flow-pro.teachable.com/ CONTACT: [email protected] The Andrews Pitchfork, also known as the Median Line Tool, is a technical analysis tool used in financial markets to identify potential support and resistance levels and predict price movements. It was developed by Dr. Alan Andrews in the 1960s and is based on the idea that price trends tend to develop within a channel or trend channel. Traders use the Andrews Pitchfork to identify trading opportunities. The basic idea is that when the price moves away from the median line, it may eventually revert toward it. Traders often look for price action signals, such as bounces off the upper or lower parallel lines, to make trading decisions. The Andrews Pitchfork can be applied to various timeframes, from intraday charts to long-term charts, depending on the trader's preferences and trading strategy. While the Andrews Pitchfork can be a valuable tool for technical analysis, it is important to use it in conjunction with other indicators and analysis methods to increase the accuracy of trading decisions. Like all technical analysis tools, it is not foolproof and should be used as part of a comprehensive trading strategy. Technical analysis is a powerful tool for traders seeking to make informed decisions in the financial markets. One such tool, the Andrews Pitchfork, can be even more potent when integrated with other analysis techniques like Elliott Wave Theory, support and resistance analysis, cycle analysis, and chart patterns. This article explores how the Andrews Pitchfork can be synergistically employed alongside these methods to provide traders with a comprehensive approach to market analysis. Elliott Wave Theory suggests that markets move in waves of five impulsive moves and three corrective moves. By incorporating the Andrews Pitchfork, traders can identify potential reversal and continuation points within these waves. For instance, when the price is within a corrective wave, drawing an Andrews Pitchfork from the start of the impulsive move to the end can help identify where the correction might find support or resistance, aiding in timing entry and exit points more precisely. Support and resistance levels are essential elements of technical analysis. The Andrews Pitchfork, with its three parallel lines, provides a dynamic way to visualize support and resistance zones. The median line often acts as a significant pivot point. When price interacts with this line within the context of established support or resistance levels, traders can gain more confidence in their trading decisions. Market cycles, which can vary in duration, play a crucial role in price movements. Integrating cycle analysis with the Andrews Pitchfork can help traders identify the stages of a cycle more accurately. For example, during a bullish cycle, the Andrews Pitchfork can be used to project potential target levels and entry points as the price moves along the pitchfork's lines, which represent different phases of the cycle. Chart patterns like head and shoulders, double tops, and flags often serve as leading indicators for price movements. The Andrews Pitchfork can enhance pattern recognition by providing additional confluence. For instance, if a double top pattern coincides with the upper parallel line of a pitchfork, it may reinforce the significance of that resistance level. The Andrews Pitchfork is a versatile tool that, when combined with other technical analysis methods like Elliott Wave Theory, support and resistance analysis, cycle analysis, and chart patterns, can provide traders with a more comprehensive and robust trading strategy. By integrating these techniques, traders can gain a deeper understanding of market dynamics, potentially improving their ability to make well-informed trading decisions and manage risk effectively. However, it's crucial to remember that no analysis method is foolproof, and prudent risk management is essential in all trading strategies. Chapters: 0:00 Intro & How to Draw the Pitchfork Correctly 1:01 Establishing Trend Boundaries 3:13 Confirming Support & Resistance Levels 5:06 Channel Breakouts 7:02 Divergence Confirmation 8:17 Elliott Wave Confirmation 9:15 Manipulation Confirmation 10:19 Cycle Analysis 11:24 Chart Pattern Confirmation & Enhancement 14:03 Final Thoughts