Скачать с ютуб Series 7 Exam Prep "Ford Bond, not James Bond". SIE Exam & Series 6 Exam & Series 65 Exam too! в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Series 7 Exam Prep "Ford Bond, not James Bond". SIE Exam & Series 6 Exam & Series 65 Exam too! в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Series 7 Exam Prep "Ford Bond, not James Bond". SIE Exam & Series 6 Exam & Series 65 Exam too! или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Series 7 Exam Prep "Ford Bond, not James Bond". SIE Exam & Series 6 Exam & Series 65 Exam too! в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Series 7 Exam Prep "Ford Bond, not James Bond". SIE Exam & Series 6 Exam & Series 65 Exam too!

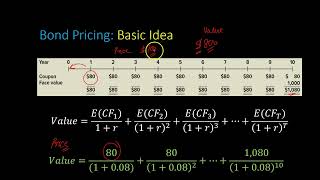

Watch this next • Series 7 Exam Prep Municipal Bonds. ... Corporate Debt Securities. Lecture 2 of 2 00:00 Capitalization of a Corporation lecture 2 of 2 0:52 Nominal yield does not change Nominal Coupon Stated Most bonds today are fully registered 7:40 Yield to price or price to yield What it pays you ÷ what it costs you = current yield Bond seesaw and using it When quoting premium bond YTC When quoting discount bond YTM Types of risk, interest and callable 24:00 Current yield Very Testable Annual interest ÷ current market price = current yield 29:22 Yield to price or yield to call 35:53 Yield to worst either YTM (basis) or YTC 40:24 Bond ratings Quality Bonds under BBB are less than investment grade quality 43:14 Unsecured Debt Debenture Full faith and credit Sub Debentures Convertible Debentures Guaranteed bond Income or adjustment bond trades flat Zero coupon no call risk, no reinvestment risk. Set sum of money at future date. Good for college funding 53:41 Types of secured bonds Mortgage bonds, real property Collateral trust bonds, marketable securities placed in escrow. Equipment trust certificates, major movable equipment 58:36 Priority in liquidation Very Testable Secured bonds Unsecured bonds Preferred stock Common stock (junior stock) Know that theoretical liquidation value is book value 1:00:31 Convertible bonds Very Testable Parity of bond = CMP of stock X conversion ratio Parity of stock = CMP of bond ÷ Conversion ratio 1:02:49 Calculating parity of bond 1:06:10 Calculating Parity of stock 1:06:59 taxation of corporate debt Interest Capital gains 1:10:40 conclusion

![Visual Calculations in Power BI - DAX Made Easy! [Full Course]](https://i.ytimg.com/vi/JITM2iW2uLQ/mqdefault.jpg)