Скачать с ютуб How To Calculate Income Tax FY 2022-23 Example (Salary Payslip) | Income Tax Calculation в хорошем качестве

income tax calculation

how to calculate income tax

income tax

new income tax calculation excel

how to calculate income tax 2022-23

how to calculate income tax 2022-23 salary

income tax calculation salary

income tax calculation salary example

taxable income

what does taxable income mean

how to reduce taxable income

taxable income calculation

choose old or new tax regime

new tax regime vs old tax regime

fincalc tv

fincalc

Скачать бесплатно и смотреть ютуб-видео без блокировок How To Calculate Income Tax FY 2022-23 Example (Salary Payslip) | Income Tax Calculation в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How To Calculate Income Tax FY 2022-23 Example (Salary Payslip) | Income Tax Calculation или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How To Calculate Income Tax FY 2022-23 Example (Salary Payslip) | Income Tax Calculation в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

How To Calculate Income Tax FY 2022-23 Example (Salary Payslip) | Income Tax Calculation

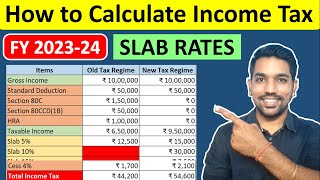

How To Calculate Income Tax FY 2022-23 Example (Salary Payslip) | Income Tax Calculation In this video by FinCalC TV we will see how to calculate income tax for FY 2022-23 with the help of salary payslip examples. There are 4 steps to calculate Income Tax: 1. Calculate your Taxable Income 2. Identify your Tax Bracket 3. Choose between Old and New Tax Regime 4. Calculate Income Tax based on Tax Regime We will check all these steps in detail with Salary Payslip Examples. Income Tax Calculator: https://fincalc-blog.in/income-tax-ca... Income Tax Calculation Article: https://fincalc-blog.in/how-to-calcul... All Excel calculators videos: • All EXCEL Calculators CHAPTERS: 00:00 How to Calculate Income Tax Intro 00:13 4 Steps to calculate Income Tax 00:42 Step #1 - Calculate Taxable Income 01:24 Income Tax on CTC or in-hand Salary? 01:55 Example-Taxable Income Calculation 09:03 Step #2 - Identify Income Tax Bracket 09:35 Income Tax Slab Rates 2022-23 11:54 Step #3 - Income Tax Calculation Example 15:46 Step #4 - Choose between Old or New Tax Regime 18:26 Download Income Tax Calculator in Excel 20:54 Income Tax Calculation Outro JOIN Telegram Group: https://t.me/fincalc_tv DOWNLOAD ANDROID APP "FinCalC": https://play.google.com/store/apps/de... Investment options to save income tax Video: • All Deductions in Section 80C, 80CCC,... Old Tax Regime vs New Tax Regime Video: • Which Tax Regime is Better: Old vs Ne... What is Taxable Income? Taxable Income is the income on which we have to calculate our income tax. Not entire monthly income is taxable. So for example: If we stay on rent and claim HRA, than HRA component in salary slip is not taxable EPF contributions made every month can be used to save income tax, as that amount is not taxable More Investment options belonging to Section 80 can be made further to make our income non taxable So the formula to calculate monthly in hand income is: In hand Income = Total monthly income – Monthly Deductions We also have to consider Standard Deduction of Rs. 50,000 which will be applicable to only Salaried Employees and Pensioners under Old Tax Regime. Standard Deduction is not applicable in New Tax Regime. IDENTIFY YOUR TAX BRACKET Since now we have seen the calculation of taxable income using a salary payslip, it is time to identify our Tax Bracket. Based on our income every year, our income tax will be calculated. And also we need to choose between Old Tax Regime and New Tax Regime to calculate income tax that we will see later in this article. Old Tax Regime: If Income between Rs. 2.5 Lacs to Rs. 5 Lacs, then 5% Tax Bracket If Income between Rs. 5 Lacs to Rs. 10 Lacs, then 20% Tax Bracket If Income above Rs. 10 Lacs, then 30% Tax Bracket New Tax Regime: Income between Rs. 2.5 Lacs to Rs. 5 Lacs, then 5% Tax Bracket Income between Rs. 5 Lacs to Rs. 7.5 Lacs, then 10% Tax Bracket Income between Rs. 7.5 Lacs to Rs. 10 Lacs, then 15% Tax Bracket Income between Rs. 10 Lacs to Rs. 12.5 Lacs, then 20% Tax Bracket Income between Rs. 12.5 Lacs to Rs. 15 Lacs, then 25% Tax Bracket Income above Rs. 15 Lacs, then 30% Tax Bracket How much Tax do you pay on 10 Lakh Salary? Based on the income tax calculator, you pay Rs. 1,06,600 as tax with Old Tax Regime or Rs. 78,000 as tax with New Tax Regime. It’s better to use New Tax Regime to pay income tax here with 10 Lakh Salary. What is Tax Rebate u/s 87A? Tax Rebate u/s 87A will be applicable to us only when our taxable income is below Rs. 5 Lacs in a financial year. According to tax rebate u/s 87A, we get tax rebate of maximum Rs. 12,500. This tax rebate will cancel the income tax for our income between Rs. 2.5 Lacs to Rs. 5 Lacs. Interestingly, Tax Rebate u/s 87A will be applicable on both Old and New Tax Regime. Which Tax Regime you should choose? Based on our analysis, we should choose new Tax Regime if income is above Rs. 15 Lacs and Old Tax Regime if income is below Rs. 15 Lacs. #incometaxcalculation #salary #fincalc #incometax ============================ LIKE | SHARE | COMMENT | SUBSCRIBE Mujhe Social Media par FOLLOW kare: Facebook : / fincalctv Twitter : / fincalctv BLOG: https://fincalc-blog.in Telegram: https://t.me/fincalc_tv Instagram: / fincalc_tv ============================ MORE VIDEOS: SIP Excel Calculator: • SIP Returns Excel Calculator| SIP vs ... Income Tax Calculator: • How To Calculate Income Tax FY 2021-2... Loan EMI Calculator: • Home Loan EMI Calculator Excel with P... 20 Years SIP Calculator: • 20 Years SIP Returns Excel Calculator... Loan EMI Prepayment Calculator: • Home Loan EMI Prepayment | How to Sav... ============================ DISCLAIMER: Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.