Скачать с ютуб Structured Credit Risk (FRM Part 2 2023 – Book 2 – Chapter 8) в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Structured Credit Risk (FRM Part 2 2023 – Book 2 – Chapter 8) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Structured Credit Risk (FRM Part 2 2023 – Book 2 – Chapter 8) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Structured Credit Risk (FRM Part 2 2023 – Book 2 – Chapter 8) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

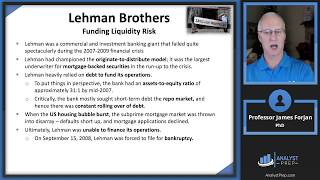

Structured Credit Risk (FRM Part 2 2023 – Book 2 – Chapter 8)

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite... AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams After completing this reading you should be able to: - Describe common types of structured products. - Describe tranching and the distribution of credit losses in a securitization. - Describe a waterfall structure in a securitization. - Identify the key participants in the securitization process and describe conflicts of interest that can arise in the process. - Compute and evaluate one or two iterations of interim cashflows in a three-tiered securitization structure. - Describe a simulation approach to calculating credit losses for different tranches in a securitization. - Explain how the default probabilities and default correlations affect the credit risk in a securitization. - Explain how default sensitivities for tranches are measured. - Describe risk factors that impact structured products. - Define implied correlation and describe how it can be measured. - Identify the motivations for using structured credit products.