Скачать с ютуб PayPal explained - how does PayPal work? Canvas Business Model PayPal в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок PayPal explained - how does PayPal work? Canvas Business Model PayPal в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно PayPal explained - how does PayPal work? Canvas Business Model PayPal или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон PayPal explained - how does PayPal work? Canvas Business Model PayPal в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

PayPal explained - how does PayPal work? Canvas Business Model PayPal

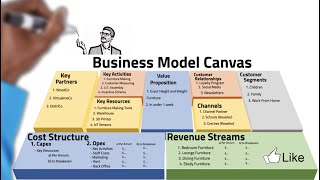

PayPal was originally founded as a money transfer service by Confinity in 1999 and became part of X.com due to the merger between X.com and Confinity in 2000. In 2002, PayPal went public and was bought by eBay for 1.5 billion US dollars. From 2015, PayPal was once again split from eBay, and the businesses were listed as two separate companies. The spin-off reduced eBay’s share price by about 50% until eventually PayPal overtook it in the S&P 100. Today, PayPal is one of the most popular online payment systems in the world. PayPal has hundreds of millions of active user accounts and is present in most countries of the world. It processes transactions in more than 100 currencies. The two-sided platform provides a stage for the secure global exchange of funds between its two customer segments: consumers and merchants. Consumers are individuals who shop, send and receive money, and merchants are businesses that accept payments both online and offline. PayPal's most important key activity is the management between customers, banks, and merchants, acting as a single platform for all parties to conduct payments. PayPal offers flexibility to customers and merchants by allowing them to use a variety of financial sources, including bank accounts, their PayPal account balance, a PayPal credit account, credit or debit cards, or other stored value products such as gift cards and vouchers. In addition, merchants are offered authorisation and payment processing capabilities, as well as instant access to funds, alongside an end-to-end payment solution. Consumers can also transfer money peer-to-peer, sending funds directly from one person to another. PayPal's revenue streams are charging fees for processing payment transactions, currency exchange, PayPal credit products, subscription fees, gateway services, partnerships and the provision of other value-added and payment-related services. PayPal charges transaction fees every time individuals send or receive money. These fees are calculated on the sent amount and on a country specific basis. When exchanging currencies, fees depend on the daily exchange rates and the currency itself. While PayPal does offer 24/7 customer support, it follows a self-service approach where customers and merchants can complete and use services on their own without the help of a PayPal employee. It also offers volume discounts, referral programs and a quick configuration. As PayPal mainly operates online, its most important channel is its own website and its mobile application, where users will spend most of their time interacting with their accounts. Another very important channel is through checkouts at merchants, where payments are completed. It also has indirect customer contact through subsidiaries such as Venmo and Xoom. Key partners are online market places and mobile operating system providers. As a payment processor, PayPal's key partners are also banks, credit card providers like Mastercard and Visa, as well as other payment processors and software developers. The videos explain different fintech business models and refer to the book Fintech Business Models by Matthias Fischer published in February 2021. The channel covers fintechs in the area of payments, robo advisory, Personal Finance Management, crowdfunding, artificial intelligence, blockchain, cryptocurrency and innovative digital solutions in banking.