Скачать с ютуб Best Dividend ETF 🔥 DIVB vs. SCHD Explained в хорошем качестве

how to invest

investing

stock market

stock market for beginners

how to invest money

how to invest in the stock market

investing in stocks

investing for beginners guide

beginners guide to investing

investment portfolio

investment strategy

beginner investors

investment income

income investing

Income investing

investing tips

dividends

dividend etf

ishares

DIVB

SCHD

ETFs to buy

which ETF is better to buy?

dividend income

Скачать бесплатно и смотреть ютуб-видео без блокировок Best Dividend ETF 🔥 DIVB vs. SCHD Explained в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Best Dividend ETF 🔥 DIVB vs. SCHD Explained или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Best Dividend ETF 🔥 DIVB vs. SCHD Explained в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

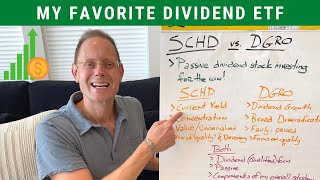

Best Dividend ETF 🔥 DIVB vs. SCHD Explained

Recommended tools: 💰 Open your account on MooMoo.com: https://j.moomoo.com/00NFHa 💰 https://www.seekingalpha.link/268QWNW... 💰Use Stock Rover for your needs: https://www.stockrover.com/plans/stoc... 🤑 My 6 Fund Portfolio setup https://m1.finance/65k-2G0Lywfc 💰 https://m1.finance/gWLPwe7Y3w4H ~When you use these links, you would be helping the channel as we get paid a referral fee. ~ ******* In this video, Dennis discusses two Dividend ETFs - iShares Core Dividend ETF (DIVB) & the Schwab US Dividend Equity ETF (SCHD). The iShares ETF aims to track the Morningstar US Dividend Buyback Index, focusing on US companies that pay dividends and engage in share buybacks. On the other hand, the Schwab ETF tracks the Dow Jones US Dividend 100 Index, selecting companies based on strong fundamentals and dividend payouts. The iShares ETF incorporates a dual approach of dividends and share buybacks, while the Schwab ETF focuses solely on companies with a strong track record of paying dividends. The video explains the benefits of stock buybacks for investors, using the example of Apple, and how they can contribute to higher EPS and tax efficiency compared to dividends. Performance-wise, the iShares ETF has shown competitive returns driven by dividends and share buybacks, while the Schwab ETF has provided steady and reliable returns, particularly in volatile markets. The video also compares the Dividend yield and growth of both ETFs, with the Schwab ETF typically offering a higher yield with consistent dividend growth. The Schwab ETF is favored for its lower volatility, while the iShares ETF provides a comprehensive approach to capital returns through dividends and buybacks. The video also shows a brief comparison of assets under management and the dividend yield and growth prospects of each ETF. ******* What you'll find in this video: 💵 Introduction to DIVB vs. SCHD Dividend ETFs 💵 Overview of iShares Core Dividend ETF(DIVB) 💵 Overview of Schwab U.S. Dividend Equity ETF (SCHD) 💵 Key Differences and Similarities between DIVB & SCHD 💵 Dividend Yield and Growth of DIVB & SCHD 💵 Risk Factors and Considerations 💵 Who Should Invest in Each? 💵 Conclusion ******* WATCH NEXT 👇 👉🏼Best ETFs to Invest NOW 🔥 Monthly Dividends and Growth: • Best ETFs to Invest NOW 🔥 Monthly Div... 👉🏼STOP making these 5 Compounding Mistakes | Invest to Earn: • STOP making these 5 Compounding Mista... ******* #dividends #dividendetfs #etf #etfs #ishares #schd #divb #dividendincome #incomeinvesting #longterminvesting #investmenttips #investing #passiveincome #investmentstrategy #financialgoals #beginnersguide ******* Join Always Be Compounding Club: https://www.alwaysbecompounding.club/ Make sure to subscribe to my newsletter, where I share advice on how to make the right investment decisions. In this channel I share information about developing the best investment strategy, designing your own investment plan, creating passive income through investment, and useful information for anyone who wants to grow their wealth, like a smart investor. ******* Follow Me: Twitter: / dennis_a_chen LinkedIn: / dennis-chen-cfa-4476472 Instagram: / dachen628 *******