Скачать с ютуб Why is Parkway Life REIT's Price Dropping Since 1 March 2023 | 🦖 в хорошем качестве

investing

investing iguana

the investing iguana

ParkwayLifeREIT

real estate investment trust

REIT sector

stock analysis

financial performance

market trends

stock price

investment insights

revenue growth

net property income

Japan operations

market expectations

DDM-based target price

stock potential

analyst ratings

fundamentals

valuation

investment strategy

financial advisor

research

undervalued stock

investment goals

stock market

dividend yield

Скачать бесплатно и смотреть ютуб-видео без блокировок Why is Parkway Life REIT's Price Dropping Since 1 March 2023 | 🦖 в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Why is Parkway Life REIT's Price Dropping Since 1 March 2023 | 🦖 или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Why is Parkway Life REIT's Price Dropping Since 1 March 2023 | 🦖 в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Why is Parkway Life REIT's Price Dropping Since 1 March 2023 | 🦖

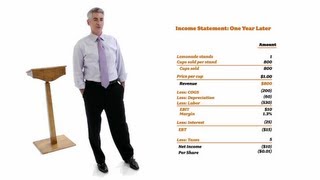

🟩🟩 Join Investing Iguana, your trusted guide to the world of investing, as we delve into the intriguing realm of real estate investment trusts (REITs). In this video, we focus our attention on Parkway Life REIT, a captivating specimen that has experienced a downward trend since March 1, 2023. Are you wondering why Parkway Life REIT is losing its luster? Fear not, for we have the answers you seek. 🟡TIMESTAMP ============= 0:00 - Introduction to Parkway Life REIT's price drop 0:34 - Assurance that Parkway Life REIT is not in trouble 1:03 - Positive performance in 1Q23 business update 1:45 - Revenue drop in Parkway Life REIT's Japan operations 2:14 - Increase in Parkway Life REIT's gearing and capex funding 2:51 - Lowered target price and altered market expectations 3:31 - Explanation of factors influencing stock price drop 4:17 - Upgraded rating for Parkway Life REIT with potential return 4:55 - Factors to consider when deciding to buy Parkway Life REIT 5:46 - Importance of personal financial goals and research in investing 🟩 Let's start by assuring you that Parkway Life REIT is not facing any significant troubles. In fact, it delivered a commendable performance in its 1Q23 business update. With a 2.5% year-on-year increase, the income available for distribution reached S$22.1 million, supported by a remarkable 21.7% and 23.5% rise in gross revenue and net property income (NPI) respectively. Contributing to the revenue boost was the acquisition of five nursing homes in Japan and higher rents from Singapore properties under new lease agreements. 🟩 However, Parkway Life REIT faced challenges as well. Despite the overall positive numbers, its Japan operations reported a 7.4% year-on-year drop in revenue/NPI in 1Q23, influenced by the weakening yen. Additionally, the REIT's gearing increased from 36.4% to 37.5% due to additional capital expenditure funding for its Singapore hospitals. 🟩 Another contributing factor to the stock's decline was a shift in market expectations, leading to a lowered DDM-based target price of S$4.50. This adjustment considered a higher cost of equity and an increased Japanese 10-year bond yield. 🟩 While the fundamentals of Parkway Life REIT remain strong, the stock price has been impacted by a combination of currency depreciation, heightened gearing, and modified market expectations. Nevertheless, the stock still holds potential. In fact, some analysts have upgraded their rating to 'ADD' after observing the almost 10% decline in share price since March 2023, projecting a potential total return of 17%. 🟩 Determining the right time to buy Parkway Life REIT depends on several factors. Firstly, assess the company's fundamentals, such as earnings, revenue growth, debt levels, and management efficiency. Reports indicate positive performance in these areas, with robust revenue growth, high net property income (NPI), and a healthy distribution per unit (DPU). 🟩 Secondly, consider valuation metrics like the Price to Earnings (P/E) ratio and Dividend Yield. The former compares the stock price to its earnings, while the latter relates the annual dividend payment to the stock price. 🟩 Lastly, factor in market expectations and sentiment. While the DDM-based target price has been lowered, the recent decline in share price and the upgraded rating suggest that the stock may be undervalued. 🟩 Determining the right price point requires careful consideration of your personal financial goals, risk tolerance, and investment horizon. It's advisable to consult a financial advisor or conduct thorough research before making any investment decisions. Remember that investing carries inherent risks, and it's crucial to be comfortable with the level of risk you're assuming. 🟩 In conclusion, the stock market can be a jungle, filled with unpredictability and challenges. Yet, it offers rewards to those with the patience and determination to navigate through it. Stay informed, keep your investing boots on, and join us on this adventure. If you found this video helpful, please give it a thumbs up and subscribe to our channel for more insightful financial tips and tricks. Don't forget to click the bell icon to receive notifications about our future videos. Thank you for watching The Investing Iguana, where we strive to provide valuable knowledge. If you have any questions or feedback, please leave them in the comments section below. We look forward to hearing from you. Stay tuned 🔔 Make sure to SUBSCRIBE and turn on notifications, so you never miss any of our videos: https://www.youtube.com/@InvestingIgu... "Investing is a long-term game. Be patient, disciplined, and informed." - The Investing Iguana 👍 If you found this video helpful, please give it a thumbs up, and share it with your fellow investors. 🟥 Remember, always conduct your own research and consult a financial advisor before making any investment decisions. Happy investing, and see you in the next episode!