Скачать с ютуб Warren Buffett’s Essential Advice for Stock Investors (3 Key Principles) в хорошем качестве

Warren Buffett’s Essential Advice for Stock Investors

Warren Buffett advice

warren buffett advice for beginners

warren buffett

warren buffet

advice for stock investors

warren buffett advice for investors

warren buffett's advice on investing

warren buffett 3 rules

warren buffett 3 key principles

3 rules warren buffett

michael jay

value investing

3 principles warren buffett

buffett investing advice

buffett investing rules

buffett 3 rules

buffett

how to invest

Скачать бесплатно и смотреть ютуб-видео без блокировок Warren Buffett’s Essential Advice for Stock Investors (3 Key Principles) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Warren Buffett’s Essential Advice for Stock Investors (3 Key Principles) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Warren Buffett’s Essential Advice for Stock Investors (3 Key Principles) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

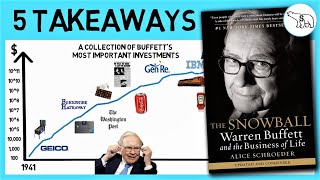

Warren Buffett’s Essential Advice for Stock Investors (3 Key Principles)

Warren Buffett's most important investing advice is essential for all stock investors. In this video, we discuss Buffett's 3 rules for long term investment success and how you can apply them to your own portfolio. Subscribe here for more content: http://bit.ly/SubscribeMichaelJay ► Access my stock portfolio & financial spreadsheets here: https://michaeljay.teachable.com/p/mi... In 1995, Warren Buffett shared his 3 most important investing principles during the Q&A session of Berkshire Hathaway’s annual meeting. In this clip, Warren Buffett was asked about how he estimates the intrinsic value of stocks and how that compares to the intrinsic value calculated by his mentor, Benjamin Graham. In classic Buffett fashion, he provides clear and timeless advice to investors that we can still use and apply today. Note that Buffett and Benjamin Graham, had developed distinct styles of value investing that affected how they valued stocks. Buffett places little to no consideration on book value of a company when evaluating whether or not to invest. Graham on the other hand focused almost exclusively on using a variation of book value to evaluate stocks, called “net-net” value. Both men found tremendous success in their lifetimes. Buffett acknowledges that there can be differences in the exact valuation technique, but the following three key principles should be applicable to every investor seeking long term investment success. Warren Buffett's FIRST key principle is your attitude towards the stock market. This is covered in detail in chapter 8 of the Intelligent Investor. It should be clear to investors that you must be comfortable with the fact that the market will swing over the course of time. Swings may be as high as 50% increases from an stock’s lowest price and 33% decreases of the stock’s highest price at various points over the next five years. Those stock quotations are there to be taken advantage of by investors, not the other way around. Below is one paragraph from that chapter which was highlighted by the editor as likely one of the most important passages in the entire book: The true investor is scarcely ever forced to sell his shares, and all other times he is free to disregard the current price quotation. He need pay attention to it and act upon it only to the extent that suits his book, and no more. Thus the investor who permits himself to be stampeded or unduly worried by unjustified market declines in his holdings is perversely transforming his basic advantage into a basic disadvantage. That man would be better off if his stocks had no quotation at all, for he would then be spared the mental anguish caused him by other persons' mistakes of judgment. – Benjamin Graham, Chapter 8 of The Intelligent Investor Warren Buffett's SECOND key principle is to invest with a margin of safety. This introduces the concept of intrinsic value. Intrinsic value refers to the value of a company or stock determined through fundamental analysis without reference to its market price. Understand that a stock’s price and a stock’s value are two different things, and that they don’t always align. Investing with a margin of safety means buying a stock only when it is trading below your estimate of its true intrinsic value. The larger the margin of safety, the lower the risk and higher potential for future returns. Warren Buffett's THIRD key principle is to look at stocks as businesses. This is a long term perspective that is less focused on short term stock prices and more on long term business prospects and performance. Buffett constantly will ask questions on a company’s business risk. Is the company capitalized in a way that puts the company at risk to creditors? Is the management team strong and aligned with shareholder interests? Does the company have a lasting competitive advantage or economic moat that protects it from competition? You will do better as an investor and think more about a business before investing in it or selling it off. If you enjoyed this video, please leave a LIKE and if you are new, consider SUBSCRIBING for more content like this in the future. DISCLAIMER: This video is a resource for educational and general informational purposes and does not constitute actual financial advice. No one should make any investment decision without first consulting his or her own financial advisor and/or conducting his or her own research and due diligence. Investing of any kind involves risk and your investments may lose value. CREDITS Outro: / vibin-kevatta-x-saib Saib: / saib_eats Kevatta: / kevatta SHARE THIS VIDEO This video: • Warren Buffett’s Essential Advice for... This channel: http://bit.ly/MichaelJayInvesting Michael Jay - Value Investing