Скачать с ютуб Balance Sheet Software | Schedule III Automation Tool | For Non Ind AS Entities в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Balance Sheet Software | Schedule III Automation Tool | For Non Ind AS Entities в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Balance Sheet Software | Schedule III Automation Tool | For Non Ind AS Entities или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Balance Sheet Software | Schedule III Automation Tool | For Non Ind AS Entities в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Balance Sheet Software | Schedule III Automation Tool | For Non Ind AS Entities

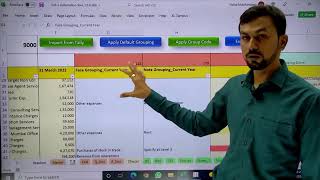

Product Link : https://accountingtool.in/product/sch... Are you making your Balance sheets in Excel? Start using our Schedule III automation software to save time. A Chartered Accountant on average spends more than 6 hours making a Balance sheet. Most of this time is spent on fixing formulas in Excel. Also, preparing financial statements is a technical job that requires updated knowledge of the Indian Companies Act and the Accounting Standards. Keeping yourself updated with these requirements takes a lot of time. Recently, there have been more than 15 new disclosure requirements for Indian financial statements. Do you want to save your valuable time by automating this process? If yes, then Balance Sheet Builder can save up to 80% of your time in preparing these financial statements. New Disclosure requirements as per Schedule III of the Indian Companies Act. Rounding of Amounts Shareholding of Promoters Trade Receivable & Payables Ageing The end use of Borrowings Title Deeds of Immovable Properties Loans & Advances to Promoters & KMP CWIP & Intangibles Ageing Benami Property Wilful Defaulter Relationship with Struck off Companies Registration of charges with Registrar of Companies Compliance with the number of layers of companies Analytical Ratios Compliance with approved Scheme(s) of Arrangements The utilisation of Borrowed funds and share premium Undisclosed income Corporate Social Responsibility (CSR) Balance Sheet Builder is a tool to prepare financial statements for unlisted companies in India. If you are using Tally accounting software, you can import your trial balance directly from Tally. You can also manually copy and paste your trial balance data. Primary groups, which appear on the face of the financial statements, are automatically picked from Tally. After filling in the secondary groups from the drop-down menu, the notes and schedules are automatically generated by the tool. Disclosures as per the Indian Companies Act are suggested in every schedule. You just have to fill the yellow cells with appropriate data. You can leave them empty if they are not applicable to you. We filled in all the secondary groupings, which only took us about 15 minutes. This was a one-time exercise and from next year onwards the same groupings will be used. You can navigate through all the statements and their schedules from the Dashboard. The balance sheet, profit-loss and cashflow statements are automatically generated and tallied by this tool. Relevant Accounting policies as applicable to the company are populated automatically. Every other schedule and disclosure applicable to the company is automatically generated based on the trial balance data. The latest amendments to schedule iii of the companies act like disclosures of ageing for trade receivables and payables are available in the Tool. Calculation of Deferred tax, Income tax or MAT is available in this Tool itself, along with various other templates for schedule III disclosures. You can leave them empty if they are not applicable to you. You can also make finalisation entries like depreciation, income tax and stock adjustment. These entries are directly updated in the financial statements. The tool suggests the available rounding options based on current turnover. You can select the desired option and all the figures in the financial statements and the schedules are rounded appropriately After the financial statements are ready you can export them into PDF format. The final document is print ready with margins and page numbering. Empty Schedules are not included in the final document. To change the financial year, go to the toolbar and press next FY. All existing data will be shifted to the previous year and you can again import fresh data from Tally. Balance Sheet builder can save at least 5 hours in preparing a financial statement. Download the free trial now and try it for yourself. https://accountingtool.in/product/sch...